Rationale

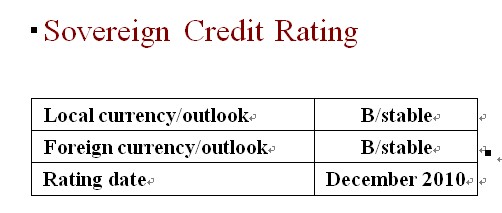

Dagong assigns “B” to both local and foreign currency

long term sovereign credit ratings for the Republic of Kenya (hereinafter

referred to as “Kenya”) based on comprehensive consideration of such factors as

its government debt burden, financial and foreign exchange capabilities, as well

as national management capacity, economic strength and financial

strength.

Increasingly higher cost in public sector wage level and

debt interest payment in recent years has made it difficult for the government

revenues to cover the expenditure, as a result the government can not maintain

fiscal balance even after receiving external financial assistance; therefore,

fiscal deficit and debt scale have showed a trend of gradual expanding. Rise in

spending on development is the main reason for the increase of debt scale, Kenya

Vision 2030 emphasizes on expansion of rural infrastructure investment, which

means the central government will increase the scale of capital investment for a

long period of time in the future. In view of the poor growth potential in

fiscal revenues, it is expected that the budget deficit to GDP ratio will reach

6.8% in the fiscal year 2010/11; meanwhile, the government financing demand will

rise more rapidly, it is expected that the total debt issuance will amount to

188 billion Euros in the fiscal year 2010/11, over the same period the relative

proportion of total public debt will maintain a trend of slow rise as well.

Although the assistance from international organizations

has, to some extent, guaranteed the government's basic debt solvency; however,

since it is difficult for the economic growth rate to return to the pre-crisis

level and the deteriorating debt situation is continuing, therefore the future

solvency of the country will be subject to certain constraints, which are

focused on the following aspects:

l

The

national development strategy is clearly positioned and well implemented, but

the future will remain subject to the unstable domestic factors; the

consolidated dominant status in regional economy has contributed to continuing

improvement in relations with international organizations, however domestic

corruption may contain the progress in bilateral relations, thereby affecting

the sustainability of external financing channel in the medium to long term.

l

Short-term prospects for economic growth was hampered by

multiple factors and it is difficult to return to the pre-crisis level, and

unbalanced regional economic development will be the main restricting factor in

future economic growth for a long-term time period.

l

The

financial system is relatively underdeveloped, which means a relatively

insufficient support to the real economy, but still has great development

potential; its sound financial regulation protects the financial system from

external shocks, the possibility of generating contingent debt for the

government is relatively low in the short-term.

l

The

revenue structure of over-reliance on taxes limits the improvement in financial

strength, so the future revenue growth will be slightly weak. With the

continuing financial incentives, fiscal deficits and government debt will remain

a slow rise in the next few years.

l

Resumption of the inflow of external capital can cover

the current account deficit in substance, and maintain a slow increase of total

foreign exchange reserves and the stable currency value; the stable external

financing ensures the sustainability of external debt in short-and-medium-term,

but in the long term it will still face political

constraints

Outlook Although

the scale of deficit and debt in Kenya is still

at a high level, but with the implementation of the new constitution, the

government will gradually optimize the structure of financial expenditure in the

future and form a more positive interaction with economic growth, therefore

maintaining debt sustainability. In the medium to long term, Kenya still

needs to bridge the domestic income distribution gap, thereby solving the

deep-seated contradictions which pose the fundamental obstacle to economic

growth. Although the smooth implementation of the 2030 Vision plan has created a

favorable condition for it, however it is still subject to fluctuations in

domestic political situation, the possibility of forced interruption can not be

completely ruled out. In view of this, Dagong keeps the stable outlook for

Kenya’s sovereign credit rating of

both the local currency and foreign currency in the next 1-2 years.

|